It is likely that the forty-year inflation high Americans have been experiencing will last well into 2023 and beyond unless there is a significant course correction. According to Bankrate’s Third-Quarter Economic Indicator poll, inflation is expected to be more significant than previous forecasts over the next twelve to eighteen months. Even under the best economic conditions in 2023, maximizing allowable benefits to offset inflationary pressures remains a smart strategy.

Rising prices can create a gap between your planned income and real bill-paying requirements. Withdrawing higher amounts from retirement savings can jeopardize your retirement plan’s long-term sustainability. Remember, prices typically don’t rise evenly across all sectors. For example, medical care costs rose slower than overall inflation—about 4 percent in the past year—while fuel, food, and utility costs increased sharply.

How to Plan for Inflation in Retirement

Targeting Growth That Exceeds Inflation

A solid retirement strategy aims for growth that outpaces inflation. However, short-term inflation spikes can disrupt this balance. It’s important to carefully manage distributions so you maintain long-term investment growth and preserve retirement income. Here are some actionable steps:

1. Budget Review and Adjust Short-Term Spending

Cutting costs is the easiest way to avoid withdrawing more from your retirement funds. Tips include:

- Reduce energy consumption at home.

- Combine errands to minimise gasoline use.

- Trim discretionary spending such as dining out, vacations, and home renovations.

If tightening your budget is not enough, consider part-time work to supplement income without jeopardizing your retirement plan.

2. Ensure Proper Wealth Allocations

Historically, stocks have delivered annual returns that stay ahead of inflation. A diversified portfolio balancing cash, bonds, ETFs, dividend-paying value stocks, and sector rotation can help maintain financial stability during uncertain times.

The S&P 500 recently dropped over 17 percent, the lowest in a decade, but past downturns like the Great Recession saw a 38.4% decline. Historically, bullish investors tend to return within months, so adjusting your portfolio and staying invested is crucial to capturing recovery gains.

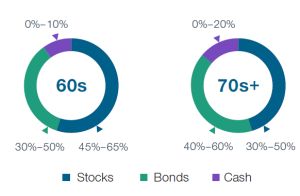

Refer to this asset allocation model from T. Rowe Price for guidance:

3. Maintain an Appropriate Cash Reserve

Managing short-term income alongside long-term growth requires regular review. While inflation erodes cash value, maintaining one to two years’ worth of expenses in cash during early retirement helps avoid forced withdrawals from long-term investments, especially during market downturns.

4. Maximize Your Social Security Benefits

Working longer increases your Social Security payout, which is based on your highest 35 years of income. Delaying benefits up to age 70 boosts your monthly payments. Social Security adjusts for inflation via the Cost of Living Adjustment (COLA), maintaining your purchasing power.

Spouses and ex-spouses should carefully evaluate options, particularly for survivor benefits. For example, if divorced for at least two years after a 10-year marriage and currently single, you may qualify for benefits based on your ex-spouse’s record. Learn more about Social Security spousal benefits.

5. Update Broader Financial and Estate Plans for Inflation

Accurate household spending estimates and adapting to inflationary changes are vital for effective retirement strategies. Your retirement plan should evolve with your personal circumstances, market conditions, and inflation rates.

Estate planning and retirement strategies are linked. Work with an estate planning or elder law attorney to ensure trusts and plans are funded sustainably and aligned with your goals.

Financial advisors or planning tools can offer valuable insights. Regularly review your investments, spending, and flexibility to maintain a strong defence against inflation.